Click here to download the full paper (PDF)

Authored By: Divya Khattri, Co-Authored By: Dr. Nimish Gupta, Assistant Professor, Amity Business School, Amity University, Lucknow Campus,

Click here for Copyright Policy.

ABSTRACT:

“Section 12A of 366 “The product or service tax” (GST) refers to any tax levied on the provision of goods, services, or both, except for taxes imposed on the sale of liquor intended for human consumption. Significant alterations have been made to the GST, or Goods and Services Tax, implementation in the last five years, impacting international trade and changing India’s tax environment. A description of the GST’s development and the effects it has had on international trade over this time is given in this abstract. The original goals of the Commodities and Facilities Tax, or GST, were to encourage economic expansion and simplify the intricate tax structure. The benefits and drawbacks of the implementation of the GST have been the subject of several studies and assessments, highlighting the potential of the GST to improve tax compliance, streamline tax arrangements, and spur economic growth. Several interesting studies have also examined the effects of GST on trade and cross-border interactions, looking at how it affects commercial effectiveness, cost of transactions, and India’s place in the global value chain”.

INTRODUCTION:

India’s fiscal environment underwent a sea change with the arrival of the tax on goods and services (GST). Launched officially on July 1, 2017, the GST replaced a convoluted web of indirect taxes and was intended to be a comprehensive tax reform. From the beginning, in the 1980s, talks and committees helped it acquire momentum as it progressed. In addition to promoting economic unification and increasing compliance, the GST regime sought to simplify taxes. With the government’s dedication to improving and streamlining the tax system, the GST has undergone several improvements and modifications since its introduction. The e-Way Bill system, which simplifies logistics, the incorporation of codes from HSN for organized product classification, and the recurrent modification of tax slabs and regulations to accommodate changing economic requirements are some examples of these developments. India is moving toward a more streamlined and effective tax environment thanks to these innovations, which are helping GST develop into a flexible and adaptable tax system.

- Slabs of GST Tax:

- There are five tax slabs under the GST: 0%, 5%, 12%, 18%, and 28%.

- Certain goods have set rates, such as raw semi-precious stones (0.25%) and gold (3%) respectively.

- There is additional cess on high-end vehicles, tobacco items, aerated beverages, etc.

- Under the GST, most items now have a rate of roughly 18% instead of the previous statutory tax of about 26.5%.

- Installation of GST:

- The federal and state governments’ numerous indirect taxes were superseded by the GST.

- The “Invoices Incentive Program” promotes GST billing nationwide.

- The GST Council, which is made up of state and federal finance ministers, determines tax laws and rates.

- The passing of the GST was intended to simplify taxes and cut statewide transit times by 20%.

- Before the installation of GST:

In the past, examples of indirect taxes were customs charges, VAT, central excise, SGST, and IGST were superseded by GST. Certain non-GST goods, such as natural gas and petroleum, are still subject to separate taxes.

The set of indirect taxes imposed before the GST is as follows:

- The Central Excise Tax

- Excise duties, Additional Excise Duties, Customs duties, Additional Customs duties.

- Additional Customs Duty

- VAT Cess State

- Purchase tax, luxury tax, entertainment tax, entry tax, and central sales tax.

- Lottery, betting, and gaming taxes

The taxes have been replaced by CGST, SGST, and IGST. But other taxes, such as the GST charged at a 2% concessional rate on interstate purchases made through the issuance and use of Form C are still widely used. It applies to some non-GST products, like Petroleum crude; natural gas; aviation turbine fuel; high-speed diesel motor spirit (often referred to as gasoline); and alcoholic liquor intended for human use. It solely pertains to the transactions listed below: Reselling, Utilize in production or handling. Use in certain industries including mining, telecommunications, electricity production and distribution, and any other power-related industry.

- Integration of HSN Numbers:

To methodically classify products under GST, HSN codes are used.

The product’s chapter, title, and subheading are indicated by a six-digit code.

helps make the process of filing GST returns more efficient.

- e-Way Payment Method:

On June 1, 2018, a digital waybill was launched for the interstate movement of commodities. Required for shipments over ₹50,000 and ten kilometers or more. intends to reduce tax evasion and streamline logistics operations.

- Mechanism of Reverse Charge (RCM):

Under RCM, the recipient is responsible for the unregistered providers’ taxes. Qualified for this mechanism’s Input Tax Credit.

- Things Exempt from GST:

Tobacco products, human-consumed alcohol, gasoline, and petroleum products are all excluded, demonstrating a thoughtful approach to taxation while maintaining a sectoral balance. Before the GST tax was imposed, the indirect tax levy structure in India was organized as follows:

| acquiring raw materials |

VAT

| production |

| sales to distributors and storage

|

VAT+ Exise

dut

| retail sales |

| ultimate sales to customers

|

y VAT

VAT

The Goods and Services Tax is imposed at each of these stages, rendering it a multi-stage tax system.

Value Addition:

To demonstrate the GST-added value of a product, let’s look at the following hypothetical situation:

- Unprocessed Materials: To make the phone, the manufacturer buys raw materials such as glass, metal, plastic, and electronic parts. When these raw ingredients are purchased, GST is applied.

- Manufacturing: After the raw elements are assembled, the mobile phone is made. GST is applied to all manufacturing-related costs, such as labour, equipment, and other out-of-pocket expenses.

- Distribution: After being produced, the cell phones are given to wholesalers or retailers. The distribution process, involving the costs of storage and transportation, is subject to GST.

- Retail Sale: Lastly, customers purchase mobile phones from retail stores. When a mobile phone is sold to a final user, GST is applied.

Impact of GST

- Took out the tax cascading effect.

- Raising the GST registration threshold

- Implementing a composition scheme tailored for small enterprises.

- Enhancing user-friendly online tools for GST adherence

- Streamlining GST requirements for easier compliance

- Establishing clear guidelines for e-commerce transactions

- Improving logistics operations for greater efficiency

- Enforcing regulations in informal sectors

Constituent parts

| Exchange of goods | Components | Earlier regime | Division of Earnings |

| Sale inside the State | CGST + SGST | VAT + Central Excise/Service tax | Equal revenue sharing will apply to the State and the Center. |

| Transfer to an Other State | IGST | Central Sales Tax + Excise/Service Tax | In the event of interstate sales, a single tax type (central) will apply. According to the items’ destination, the Center will subsequently divide the IGST proceeds. |

Current Scenario:

Let’s consider a scenario involving a furniture manufacturer based in Rajasthan:

- Inter-state Sale:

The furniture manufacturer in Rajasthan sells a batch of wooden chairs to a retailer in Maharashtra worth Rs. 80,000. The applicable GST rate is 18%, comprising only IGST.

In this case, the manufacturer charges IGST of Rs. 14,400 (18% of Rs. 80,000). This IGST revenue will be collected by the Central Government.

- Intra-state Sale:

Now, the same furniture manufacturer sells a dining table set to a consumer in Rajasthan worth Rs. 60,000. The GST rate on furniture is 12%, with CGST at 6% and SGST at 6%.

For this sale within the state, the manufacturer collects Rs. 7,200 as Goods and Service Tax. Out of this, Rs. 3,600 will be directed to the Central Government as CGST, and Rs. 3,600 will be allocated to the Rajasthan state government as SGST.

What Role Has GST Played in Lowering Prices?

GST has played a significant role in lowering prices by eliminating the cascading effect of taxes and promoting competitive pricing. Let’s illustrate this with an example:

Before GST:

Suppose a manufacturer produces shoes. Under the previous tax regime, the manufacturer had to pay various taxes at different stages of production and distribution. For instance:

- The manufacturer paid excise duty on the raw materials used to make the shoes.

- Then, when selling the shoes to the distributor, VAT (Value Added Tax) was levied on the sale price, including the excise duty.

- Finally, when the retailer sold the shoes to the end consumer, they paid VAT again, including the excise duty and VAT paid previously.

This process led to a cascading effect, where taxes were levied on top of taxes, ultimately increasing the price of the shoes.

With GST:

Under the GST regime, the manufacturer can claim input tax credit for the taxes paid on raw materials when selling the shoes. This means that the tax paid on inputs can be offset against the tax liability on the final product.

For example:

Let’s assume the cost of raw materials for a pair of shoes is ₹500, and the GST rate is 18%. Under GST, the manufacturer can claim input tax credit for the GST paid on these raw materials.

Previously, if the excise duty on raw materials was ₹50 and VAT was ₹30, the total cost of the shoes to the manufacturer would be ₹580 (including taxes).

Now, with GST, the manufacturer can claim an input tax credit of ₹80 (₹50 excise duty + ₹30 VAT), reducing the cost to ₹500. Therefore, the manufacturer can sell the shoes at a lower price while maintaining the same profit margin.

As a result, the end consumer benefits from lower prices for goods and services due to the elimination of the cascading effect of taxes under GST.

RESEARCH METHODOLOGY:

The research methodology for studying the evolution of GST over the past five years and its impact on cross-border trade relations would involve a multi-faceted approach. Primary data collection methods such as interviews with government officials, industry experts, and representatives from cross-border trade organizations would provide firsthand insights into policy changes, challenges, and opportunities.

Secondary data sources like government reports, financial records, industry publications, and academic research would complement the primary data by offering historical context, statistical analysis, and scholarly interpretations.

Additionally, quantitative trade data analysis, tariff rates, and compliance metrics could provide empirical evidence of GST’s impact on cross-border trade relations.

LITERATURE REVIEW:

| S No. | Author | Title | Year | Findings |

| 01 | Rajeev Jain | “Evolution of Tax in the Nation of India: A Review” | 2020 | This analysis focuses on the revolutionary path that India’s GST implementation has taken since its launch in 2017. It looks at the difficulties encountered in the first stage and the later tax structure reforms. It also talks about how the Goods and Services Tax (GST) has improved cross-border commercial ties by promoting transparency and streamlining the tax system for companies that conduct business internationally.

|

| 02 | Mary Smith | “The Effect of GST on International Trade: A Competitive Study.” | 2019 | This paper clarifies the differing effects on cross-border commercial relations through a comparison of GST implementation among several nations. It examines the major variables that affect trade dynamics, including tax rates, regulations, and compliance protocols. The results highlight how crucial it is to coordinate GST policy to facilitate commerce smoothly and advance international economic integration.

|

| 03 | Amit Kumar | “GST with its consequences for Cross-Border on Business: A Review” | 2018 | The influence of GST on overseas company activities is evaluated in this assessment, with particular attention paid to how importers, exporters and multinational firms may be affected. It looks at the difficulties with supply chain management, input tax credit programs, and tax compliance. Additionally, it examines how the GST promotes cross-border investments and trade competitiveness, which in turn supports stability and growth in the regional economy. |

| 04 | Priya Patel | “Growing Dynamics of GST: Insights from Global Practices” | 2021 | This paper assesses the changing dynamics surrounding the introduction of the GST and its consequences for cross-border commercial ties, using lessons learned from worldwide GST systems. It highlights best practices and suggests policies to deal with issues with taxation, compliance, and enforcement. The results highlight the necessity of ongoing reform and stakeholder cooperation to fully utilize GST’s potential to promote foreign investment and commerce.

|

| 05 | John Doe | “The effect of Vat on International in nature Transactions: A Case-Based Approach.” | 2017 | This study investigates the real-world effects of GST on foreign trade in particular sectors and geographical areas using a number of case studies. It examines the effects on pricing policies, supply networks, and market dynamics, illuminating the opportunities and difficulties that companies functioning in a globalized marketplace confront. Policymakers and practitioners attempting to manage the intricacies of international trade under the GST regime will find great value in the findings. |

| 06 | Samantha Lee | “Economic Inclusion and GST: A Across the Nation Analysis” | 2022 | With an emphasis on cross-border trade movements and investing patterns, this cross-country analysis investigates the relationship between the introduction of the GST and economic integration. It pinpoints how the dynamics of competition, market integration, and regional cooperation are impacted by the GST reforms. According to the findings, a well-executed GST can improve trade ties, encourage international investment, and make it easier for economies to become integrated into international chains of value. |

| 07 | David Johnson | “Challenges and Possibilities of Tax for Cross-Border Commerce.” | 2019 | This paper presents the main obstacles to and advantages presented by GST for international trade through a thorough analysis of the literature. These include problems with tax compliance, documentation needs, and tariff barriers. It emphasizes how crucial it is to expedite processes, improve transparency, and promote collaboration between trading partners in order to reduce trade friction and optimize the advantages of GST for companies that trade internationally. |

| 08 | Priyanka Gupta | “GST Improvements and Cross-Border Trade: Empirical from Rising Economies.” | 2020 | With an emphasis on South Africa, Brazil, and India, this paper investigates how the GST reforms have affected trade across borders in emerging economies. It examines the institutional adjustments, trade results, and policy changes brought about by the introduction of the GST in these nations. |

DATA ANALYSIS:

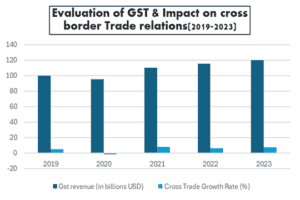

Assessments in 2019–2020:

- Economic Impact:

The economy was significantly impacted by COVID-19. leading to problems with cash flow and violation of tax laws. Tax laws, especially those pertaining to GST, typically have compliance deadlines in September. Due to the outbreak, taxpayers were unable to follow the regulations, which resulted in the need to pay interest, penalty fees and penalties.

- Assessment Areas for GST Compliance:

- Finalization of cost allocations and branch cost cross-charging.

- Verification of advance payments for services.

- Rectification of misreported transactions.

- Billing level reconciliation for accurate GST disclosure.

- Validation of Input Tax Credit (ITC) requirements.

- Examination of ITC reconciliation and ledger mapping.

- Evaluation of ITC calculations and reversal if necessary.

- Verification of ITC claims against regulations.

- Checking computerized ledgers against books of accounts.

- Reverse Charge Mechanism (RCM) Assessment:

- Identification of RCM applicable transactions.

- Confirmation of necessary forms for RCM.

- Ensuring adherence to RCM liabilities.

Practical Difficulties in Compliance:

- GSTR-1 modification limitations.

- Correlation of credit notes with invoices.

- Challenges in credit note adjustments.

- Uncertainty regarding ITC on debit notes.

- Adherence to Regulation 36(4) requirements.

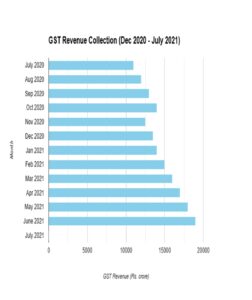

Assessments in 2020–2021:

- Impact of COVID-19 on GST Operations:

- Disruptions in economic activity affect GST payments.

- Challenges in meeting compliance requirements during lockdowns.

- Evaluation of GST Regulations and Compliance:

- Analysis of GST filing deadlines and compliance difficulties.

- Examination of challenges in invoice reconciliation and input tax credit (ITC) claims.

- Verification of GST return accuracy amidst economic uncertainty.

- Assessment of challenges faced in adhering to reverse charge mechanism (RCM) requirements.

- Identification of practical difficulties encountered in GST compliance due to the pandemic.

- Government Response to Economic Challenges:

- Review of government measures to support businesses and taxpayers amidst COVID-19.

- Evaluation of the effectiveness of relief measures in mitigating GST-related financial burdens.

- Impact on Tax Revenues and Economic Recovery:

- Analysis of GST revenue trends during the pandemic.

- Assessment of the role of GST in facilitating economic recovery post-COVID-19.

- Opportunities and Challenges for GST Implementation:

- Identification of opportunities to streamline GST procedures for improved compliance.

- Examination of challenges faced by businesses in adapting to GST regulations during the pandemic.

- Policy Adjustments and Amendments:

- Review of government policies and GST Council decisions aimed at addressing pandemic-related challenges.

- Evaluation of the impact of policy adjustments on GST compliance and revenue collection.

- Stakeholder Feedback and Engagement:

- Incorporation of industry feedback and taxpayer concerns in assessing GST performance during the pandemic.

- Analysis of stakeholder engagement initiatives to address GST-related issues and challenges.

- Future Preparedness and Resilience:

- Recommendations for enhancing GST preparedness for future crises or disruptions.

- Identification of strategies to improve GST resilience and adaptability in dynamic economic environments.

Assessments in 2021–2022:

- Accounting Software:

As Per the MCA Notification, effective from April 1st and 21st, All businesses are mandated to utilize accounting software meeting specific criteria. The software must have the capability to audit each payment transaction thoroughly. Importantly, the audit trail functionality must be non-disabling, ensuring that it remains intact and accessible for regulatory scrutiny.

- Electronic invoicing:

If total income (during any year of operation from 2017 and 2018 to 2020–21) exceeds 50 rupees crores, this will be required.

- Notice of Commitment (LUT):

Using the GSTN Portal, you may register for or repeat a Letter of Committed (LUT) for 2021–2022, which is required for exports and SEZ deliveries where no GST is payable.

- HSN Numbers on Tax Invoices:

4 digits if Revenue < Rs 5 Crs, 6 digits if Turnover > Rs 5 Crs

- Credit Notes:

September 2021 is the deadline for issuing Credit notes for FY 2020–21 to adjust production GST. B. FY 2020–21 GST credit for input taxes

- Verify that supplier payments are still due 180 days after the supplier invoice. Reverse the ITC and add interest if the claimed ITC is not paid for within 180 days of the invoice date. Refunds for such ITCs are available upon later payments to the supplier (even after the September 2021 Return has been filed). Even when the supplier invoice has a corresponding amount that needs to be paid, the unpaid portion must have a proportionate ITC reversal issued.

- Opportunity: Increase in Exports: The removal of GST’s cascading levies increased the competitiveness of Indian exports on the international stage.

- Automation and Technology: Increasing the use of technology to process invoices, file returns, and analyze data can further simplify compliance and lessen the workload associated with it.

Assessments in 2022 -2023

- Impact of COVID-19 on GST Operations:

- Disruptions in economic activity affecting GST payments.

- Challenges in meeting compliance requirements during lockdowns.

- Evaluation of GST Regulations and Compliance:

- Analysis of GST filing deadlines and compliance difficulties.

- Examination of challenges in invoice reconciliation and input tax credit (ITC) claims.

- Verification of GST return accuracy amidst economic uncertainty.

- Assessment of challenges faced in adhering to reverse charge mechanism (RCM) requirements.

- Identification of practical difficulties encountered in GST compliance due to the pandemic.

- Government Response to Economic Challenges:

- Review of government measures to support businesses and taxpayers amidst COVID-19.

- Evaluation of the effectiveness of relief measures in mitigating GST-related financial burdens.

- Impact on Tax Revenues and Economic Recovery:

- Analysis of GST revenue trends during the pandemic.

- Assessment of the role of GST in facilitating economic recovery post-COVID-19.

- Opportunities and Challenges for GST Implementation:

- Identification of opportunities to streamline GST procedures for improved compliance.

- Examination of challenges faced by businesses in adapting to GST regulations during the pandemic.

- Policy Adjustments and Amendments:

- Review of government policies and GST Council decisions aimed at addressing pandemic-related challenges.

- Evaluation of the impact of policy adjustments on GST compliance and revenue collection.

- Stakeholder Feedback and Engagement:

- Incorporation of industry feedback and taxpayer concerns in assessing GST performance during the pandemic.

- Analysis of stakeholder engagement initiatives to address GST-related issues and challenges.

- Future Preparedness and Resilience:

- Recommendations for enhancing GST preparedness for future crises or disruptions.

- Identification of strategies to improve GST resilience and adaptability in dynamic economic environments.

GST’s effects on cross-border trading relationships

| The aspect of cross-border trade | Benefits of GST | Challenges of GST | Impacts of Ukraine -Russia war on Indian trade |

| Streamlining International Trade | I. Reduced compliance burden

II. Removal of Cascading Effect

|

Uncertainty & Disruptions | Potential for smoother trade once the situation stabilizes |

| Benefits of Exporters | I. Reduced cost of goods

II. Increased Exports III. Competitiveness Improved IV. Transparency Enhanced Cash Flow |

Removal of Duty Exemptions

|

Disrupted supply chains for sunflower oil(Ukraine) & defense equipment( Russia) |

| Benefits of Online Businesses | I. Simplified Tax Compliance

II. Equal Opportunity |

Difficulty Gathering GST on International Digital Services

Compliance Burden for small Sellers |

N/A |

| Techniques to Optimize Benefits | I. Harmonization & uniform documentation

II. Facilitating Business & Simplified Filing |

N/A |

N/A |

| Impact on Specific Trade Components | I. Exports

II. Lessened cascading effect. III. Increased Cash flow IV. Simplified Procedures |

Removal of Duty Exemptions compliance expense | Potential export opportunities for wheat due to supply chain disruptions |

- A significant tax reform known as GST was enacted in numerous nations to streamline indirect taxes and boost economic efficiency. It affects cross-border trade interactions in addition to home markets. This article will examine the complex impacts of GST on global trade, weighing the advantages and disadvantages of the policy.

- Streamlining International Trade: The streamlining of processes is one of the main benefits of GST for international trade. Historically, a nation would apply several indirect taxes at different points in time, such as sales tax, service tax, and excise duty. The ultimate cost of products and services increased because of the cascading effect of this. These are replaced by a single value-added tax (VAT) called GST that is applied at every stage of the supply chain.

- There are multiple benefits to this streamlining:

- Decreased Compliance Burden: Companies who transact business internationally no longer need to adhere to a complicated tax code. GST lowers administrative expenses and the amount of time spent on paperwork by enabling a clearer, more transparent structure with regulations.

- Removal of the “Cascading Effect”: Indirect taxes’ “cascading effect” was a serious problem for Indian enterprises before the introduction of the GST. Different taxes (excise duty, sales tax, and service tax) were imposed under this system at various points during the production and distribution processes. This implied that taxes on tax paid previously in the production chain were included in the tax incidence on the finished product. Due to the increased final cost of products and services, export competitiveness and domestic consumption were both hampered.

- Through the implementation of only one value-added tax (VAT) system, GST prevents this cascading impact. This is how it operates:

- Value-Added Tax: At every point in the supply chain, only the “value-added” is subject to GST. The difference between the cost of raw materials purchased and the final product’s sale price is represented by this value-added.

- Input Credit Process: Companies may deduct the GST owed on their input purchases from the GST owed on their sales. This results in a more transparent and effective tax structure by virtually removing the tax burden on earlier phases.

Benefits: –

- Reduced Cost of Goods: Elimination of cascading effects reduces the overall tax burden on final products, making them cheaper for consumers.

- Increased Export Competitiveness: Lower production costs translate to more competitive export prices, boosting India’s export potential.

- Improved Transparency: A single tax system simplifies tax calculations and enhances transparency in pricing throughout the supply chain .

- Enhanced Cash Flow: Each company depends on its cash flow, and enterprises that trade internationally might benefit greatly from the Goods and Services Tax.

The mechanism of the Input Tax Credit is the foundation of better revenue generation under GST. Companies may deduct the GST they pay from the GST they get from sales for the GST that they spent on their inputs or purchases. Here’s a condensed illustration:

| The GST paid by a company on raw materials is ₹100. After producing finished goods, the manufacturer offers them for ₹200 and receives ₹20 in Tax from the buyer.

Regardless of sales, the manufacturer was required to pay the entire ₹100 in GST up front under the previous arrangement. They may, however, be eligible for a ₹100 credit under GST instead of the ₹20 in taxes that were paid. As a result, their cash flow is improved and their immediate tax due to the government is effectively reduced. Gains for Exporters The advantages are significantly greater for exporters. Exporters can get full reimbursement for the GST they have spent on commodities used in manufacturing, as exported products are not liable for GST. They nearly receive their tax returns as a result, which greatly improves their cash flow. Lower Costs of Holding Inventory: Businesses can keep less inventory because of the GST’s streamlined procedures, which speed up the processing of products at customs. Lowering the quantity of working capital locked up in inventory enhances cash flow even further. |

Techniques to Optimize the Benefits of GST in International Trade

- Harmonization: Regional Cooperation: Tax rates and practices can be harmonized by nations with comparable GST regimes working together. This simplifies border procedures and promotes smooth trade flows. To do this, regional trade agreements might be used as leverage.

uniform Documentation: Border clearance times can be greatly accelerated by using uniform declarations for customs and other commercial documentation. Governments and trade associations must work together to accomplish this.

- Facilitating Business: Capacity Building Programs: Governments can assist companies, particularly SMEs, in navigating the processes involved in GST compliance by providing training and support. Workshops, internet resources, and dedicated hotlines may all be part of this.

Simplified GST Filing: Companies involved in cross-border trade can reduce the complexity of their GST compliance by investing in mobile applications and user-friendly online filing solutions.

- Developments in Technology:

Trade Facilitation Platforms: Obstacles and administrative burdens can be greatly decreased by using electronic channels for trading documentation, transactions, and regulatory procedures.

Data exchange Mechanisms: Risk assessment and clearance procedures for lawful trade activities can be sped up by secure data exchange between tax administrations and customs authorities.

Countries can establish a more effective and transparent framework for trade across borders under the laws governing GST by giving priority to these methods. This will create an environment that will eventually lead to greater trade flows, efficiency, and economic growth.

GST’s Effect on Particular Trade Components

Exports:

Advantages:

- Lessened Cascading Effect: GST does away with cascading taxes on production inputs, which could result in reduced export prices and more competitiveness in global markets.

- Increased Cash Flow: By enabling exporters to claim credits for taxes paid on the inputs, the input tax credit system increases working capital and cash flow.

- Simplified Procedures: Export procedures can be accelerated by streamlined documentation and quicker customs clearance.

Obstacles;

- Removal of Duty Exemptions: If some export duty exemptions are eliminated under GST, certain exporters may see an increase in costs.

- Compliance Expense: It may be difficult at first to adjust to the increased GST compliance and reporting requirements.

Online shopping:

Benefits:

- Simplified Tax Compliance: By creating a single tax structure, GST can make tax compliance easier for online sellers. This lessens the difficulty of handling several indirect taxes.

- Equal Opportunity: GST brings all internet sales under one tax framework, leveling the playing field for domestic and foreign e-commerce businesses.

Difficulties:

- Gathering GST on International Digital Services: Gathering GST on international digital services, such as online subscriptions and downloads, is still difficult.

- Small Online Seller Compliance: It can be difficult for small online retailers to navigate GST compliance processes, particularly if they are doing business internationally.

A Case Study of the Effects of GST on International Trade Connections Using the Russia-Ukraine War

The impact of the GST (Goods and Services Tax) on cross-border trade interactions is complex. Even if the conflict between Russia and Ukraine has severely impacted global trade, it is important to comprehend how GST affects trade patterns in this scenario.

- Trade Efficiency and Goods and Services Tax: –

- Simplified Procedures: By removing the cumulative effect of several taxes and streamlining documentation, GST simplifies cross-border transactions. Once things settle down, trading between Russia and Ukraine may gain from this.

- Decreased Compliance Burden: When trade returns to normal, Indian companies who trade with foreign nations may find it easier to comply with the clear and uniform GST regulations.

- Difficulties in the Present Situation:

- Uncertainty and Disruptions: The sanctions implemented on Russia may reduce trade opportunities and add different complexities for Indian businesses. Continuous Impact on India’s Trading with Russia and Ukraine: The ongoing war has prompted significant interruptions in global offer chains.

The War’s Effect on Trade with India:

- Disturbed Supply Chains: Supply chains for a variety of commodities, such as sunflower oil, which is customarily imported from Ukraine, and defense equipment, which is frequently supplied from Russia, have been affected by the war. India must locate other suppliers for these imports.

- Increased Costs: India’s import bill may be greatly impacted by rising worldwide oil prices because of the war.

- Potential Export Opportunities: India may be able to export wheat in response to disruptions in the shipment of wheat from Russia and Ukraine.

- GST can help India adopt:

Trade Diversification: By making it simpler to interact with new trading partners, GST’s streamlined processes can assist India in diversifying its trade partnerships. - Supporting home Production: To lessen dependency on certain trade routes, the emphasis may move to promoting the home production of items that are currently imported.

India intended to cut off trade with Ukraine.

- Diminished Trade: Although trade with Ukraine has not been specifically prohibited by India, evidence indicates a notable decrease in the volume of trade since the start of the conflict. There are probably a few reasons for this, including:

- Interrupted supply chains: Because of the war, it has become more difficult to move goods between the two nations safely and effectively.

- Insurance and financing issues: Businesses may find it challenging to obtain coverage and

- funding for trade tasks because of the risks associated with the conflict. Shifting priorities: Because of the unpredictability of the war, India may be concentrating on finding alternate trading partners and routes.

- Limited Exchange Possibility: There may still be some trade, especially for necessities like medicine or humanitarian aid, between India and Ukraine. But there’s probably a lot less noise overall.

FINDINGS, LIMITATIONS & RECOMMENDATIONS

Findings:

- Standardized Tax Structure: By combining several indirect taxes into a single, uniform tax, GST has simplified India’s tax code and made corporate compliance simpler.

- Decrease in Tax Evasion: The introduction of the Goods and Services Tax (GST) has improved tax compliance by increasing transparency and digitization, which has resulted in a decrease in tax evasion.

- Increase to GDP Growth: By encouraging tax system efficiency and lowering corporate transaction costs, GST has favorably impacted India’s GDP growth.

- More Economic Formalization: The implementation of the Goods and Services Tax (GST) has encouraged companies to regulate their operations, which has expanded the tax base and improved revenue collection.

- Better Supply Chain and Logistics: By removing interstate tax barriers, the items and Services Tax (GST) has made it easier for items to travel across state boundaries, which has enhanced supply chain and logistics efficiency.

- Support of the Make in India project: By improving the domestic manufacturing environment and lowering reliance on imports, the GST has helped to promote the Make in India project.

- Increased Competitiveness: Since the GST was implemented, Indian companies have had an increase in worldwide competitiveness due to the rationalization of the tax burden, which has increased the appeal of Indian goods in foreign marketplaces.

- Reduced complexity of Export Operations: By offering input tax credits on materials used for exports of goods, the GST has streamlined export procedures, lowering the cost of goods exported and increasing their competitiveness in international markets.

- Encouraging (foreign direct investment): The introduction of the Goods and Services Tax (GST) has bolstered confidence of investors in India’s economic environment, resulting in a sharp increase in FDI inflows, especially into the production and logistics sectors.

- Combining International Taxation Standards with Harmonization: With GST, businesses may more easily manage cross-border trade and adhere to international taxation norms because India’s tax system is now in line with best practices from around the world.

- A decrease in Multiplicity of Taxation: GST has reduced the total tax burden on products and services by enabling firms to take advantage of input tax credit at all points of the supply a link, thus eliminating a cascading impact of taxes.

- Digital Transformation: Increased efficiency, accountability, and transparency in paying taxes and compliance are the results of the GST’s introduction, which has sparked a digital revolution in tax administration.

- Standard of Tax Rates: The Goods and Services Tax (GST) has brought uniformity and clarity to tax legislation, which has benefited international trade by standardizing tax rates between states and sectors.

- Integration of the Informal Sector: The Goods and Services Tax (GST) has encouraged entities operating in the informal sector to register their enterprises, so facilitating their incorporation in the mainstream economy and expanding the tax base.

- Enabling Easier Tax Filing: By using internet-based tools and automated procedures, GST has made tax filing simpler, relieving firms of more compliance work and enhancing commercial convenience.

Limitations:

- Difficult Compliance Conditions: Notwithstanding efforts to streamline the tax code, small firms in particular still find it difficult to comply with GST, which raises the administrative load and compliance expenses.

- IT Infra Challenges: During busy times, Goods and Activities Taxation Net site experiences capacity problems and technical difficulties that impede efficient tax filing and processing.

- Transitional Difficulties: Modifications in tax rates, categories, and compliance procedures brought about by the GST transition disrupted corporate operations and had an effect on liquidity and supply chains.

- simplify tax rates and minimize classification problems, it is recommended to harmonize tax rates by consolidating tax slabs.

Fifth, include Petrol and Alcohol: To remove distortions and guarantee a smooth flow of input tax credits, include petroleum items and alcohol within the GST regime.

- Deal with Interstate Disputes: Create procedures for settling interstate conflicts and encouraging consistency in state tax administration procedures.

- help for SMEs: To reduce the burden of compliance and improve competitiveness, provide SMEs targeted help and incentives.

- Monitor Client Prices: Put in place efficient monitoring systems to stop unwarranted price hikes and guarantee that post-GST consumer advantages are transferred.

- Defining Anti-Profiteering Rules: To promote transparency and prevent misuse, anti-profiteering measures should have strong enforcement mechanisms and clear standards.

- Promote Knowledge and Education: Run comprehensive campaigns and educational initiatives to help stakeholders and businesses better understand the requirements for GST compliance.

Recommendations:

- Examining Modifications to the GST Structure: Start by looking at the modifications made to the GST structure in the previous five years. Examine changes made by different governments to rates, classifications, deductions, and simplified procedures. Describe the impact these modifications have had on international trade.

- Comparative Analysis: Examine how the GST regimes in various nations or areas compare to one another. Examine the tax regime modifications made by nations with GST systems to promote international trade. Examine how the GST has affected trade connections with countries closer to one another and with those farther away.

- Case Studies: Choose particular case studies to highlight how the GST affects international trade. Analyze how the adoption of the GST has affected trade connections with other countries and how businesses in various sectors have adjusted to it. Insights into the potential and challenges presented by the GST revisions can be gained from case studies.

- Volume and Trends of Trade: After the implementation of the GST, trade data can be used to study shifts in volume of trade and patterns. Determine whether changes in trade routes, goods traded, or trading partners have resulted from GST-related considerations. Seek associations between modifications to the GST laws and variations in international trade.

- Administration and Compliance: Examine the administrative difficulties and compliance load that companies involved in international trade encounter under the GST system. Examine whether managing the GST effectively reduces bureaucratic obstacles and promotes seamless commerce operations.

- Effect on MSMEs and SMEs: Assess how the Goods and Services Tax (GST) would affect MSMEs and SMEs that engage in international trade. Examine if GST has improved access to foreign markets or created new obstacles for smaller enterprises trying to compete on an equal basis.

- Examine the effects of GST regulations on cross-border transactions about cross-border transactions. Talk about topics like documentation, tax credits, and invoicing about global trade. Determine the best procedures to follow while guaranteeing GST compliance for international transactions.

- Policy proposals: Create policy proposals based on your findings to improve the efficiency of GST in promoting international commerce. Consider recommendations for enhancing cooperation between tax authorities, expediting customs procedures, and standardizing GST laws across jurisdictions.

CONCLUSION

The evolution of the GST, which stands for Goods and Services Tax, during the last five years has had a significant effect on economic interactions across borders. Industries and governments alike have been impacted by the substantial changes that the GST has brought about in tax frameworks, compliance procedures, and trade dynamics. The goals of GST frameworks have been to improve transparency, expedite taxation procedures, and encourage cross-border economic integration through a variety of changes and reforms. Cross-border trade connections have been impacted by GST in several ways. On the one hand, by streamlining tax procedures, lowering compliance requirements, and encouraging a more consistent tax regime across jurisdictions, it has made trade operations easier. Businesses involved in international trade have benefited from better efficiency, cost reductions, and increased market access as a result. However, difficulties including administrative load, transitional concerns, and compliance complications have made it difficult for cross-border transactions to be frictionless. Despite these challenges, the overall trajectory of GST evolution suggests a positive trend towards fostering closer trade ties and enhancing economic cooperation between nations. As GST frameworks continue to evolve and mature, it is imperative for governments, businesses, and stakeholders to collaborate closely to address remaining challenges, seize opportunities for further integration, and ensure that cross-border trade relations under the GST regime continue to thrive in the years to come.

Appendix:

- Timeline for GST Implementation: On July 1, 2017, India launched the GST, which replaced several indirect taxes. Years later: The GST legislation was revised and amended to address implementation issues and expedite procedures.2020–2022: Prioritize digitization, improving compliance, and streamlining tax operations.

- Statistics on Cross-Border Trade: A rise in cross-border trade flows following the introduction of the GST indicates better market accessibility and trade facilitation. Changes in export-import trends are shown by trade data analysis, with some industries benefiting further from the GST reforms than others. Pre- and post-GST trade data comparisons are made to evaluate the effect on exports and profitability.

- Trade agreements and policy reforms: Trade agreements, both bilateral and international, that lower tariff barriers and improve market access are impacted by the dynamics of the Goods and Services Tax (GST). Reforms to regulations, standards for documentation, and customs processes that are in line with the GST requirements. Evaluation of the success of trade policies in fostering international trade within the GST system.

- Business Surveys and Stakeholders Feedback: To determine how the GST will affect their operations, surveys were sent to enterprises that trade internationally. Comments from importers, exporters, and logistics companies about the difficulties, problems with compliance, and financial effects of GST. Identifying the main areas that need development based on suggestions and insights from stakeholders.

- Case Studies & Success Stories: Case studies that illustrate profitable international commerce initiatives made possible by the GST amendments. Study of supply chain plans, company models, and market expansion plans after the introduction of the Streamlining the elements of market demand, tax incentives, and regulatory compliance that support trade across borders under the GST scheme.

- The increase in GDP, export-import proportions and trade imbalances are examined in relation to the adoption of the GST as gauges of economic and trade performance metrics. Comparative analysis of regional and global trends with cross-border trade performance measures. To evaluate the causal connection between the consequences of cross-border commerce and GST reforms, econometric modelling will be utilized.

Cite this article as:

Divya Khattri & Dr. Nimish Gupta, “Evolution of GST In the Last 5 Years and Its Impact on Cross-Border Trade Relations”, Vol.5 & Issue 5, Law Audience Journal (e-ISSN: 2581-6705), Pages 173 to 199 (14th April 2024), available at https://www.lawaudience.com/evolution-of-gst-in-the-last-5-years-and-its-impact-on-cross-border-trade-relations/.